Jonny Hick from our investment team explains what “Revenue Participation Notes” (RPNs) are, and how charities and social enterprises can look look at RPNs as an alternative approach to financing their growth

In December, we announced the closing of our investment into HCT Group – a social enterprise transportation company. We are delighted to back one of the UK’s flagship social enterprises on the next stage of their journey. Our investment of £500,000 was part of a round of almost £10m, bringing in mainstream and social banks, charitable trusts, foundations and impact investment funds.

Specifically we invested in the revenue participation note (“RPN”), a new structure for us and one we are very excited about as an innovative way to support registered charities and social enterprises with genuine risk capital. We want to use the closing of the HCT deal to encourage other charity and social enterprise leaders to understand RPNs as an alternative approach to financing their growth.

What is a revenue participation note?

A revenue participation note is an unsecured loan to a charity or social enterprise where the interest payments are determined by the revenue performance of that organisation. If the company grows and expands its revenues, investors share in that, but if the company doesn’t perform as expected, then investors’ interest payments fall in line with revenue, potentially to zero.

RPNs are an example of ‘quasi equity’ finance – a buzzword term, but important for social enterprises because it captures the key feature of equity investment, where investor returns are linked to the performance of the venture. For the sake of clarity however, RPNs are debt instruments, not equity, with a requirement to repay the principal in full after an agreed period of time, typically in the form of one single ‘bullet’ repayment at the end of loan. The principal repayment profile can also be structured to allow for a further level of risk sharing, where both the principal and interest are linked to performance. This is something we are structuring with a number of charities at the moment.

Why get funding through an RPN?

Many forward looking charities and social enterprises are responding to the challenging public expenditure environment, at a time of growing demand for their services, by innovating in different ways. Yet the lack of genuine risk capital available to them threatens to limit their ability to do this. Grants remain difficult to come by and whilst social investment can play a role, traditional loans can sometimes fail to meet these organisations needs, as a fixed level of repayment is required no matter how the organisation performs. With an RPN, the variable nature of the interest repayment – linked to revenue performance – go some way to addressing this, with investors taking a greater share of the downside risk of the innovation.

A further benefit is that as these structures become more commonplace, commissioners may start to recognise quasi-equity as equity rather than debt. This has the benefit of reducing the apparent gearing and financial risk of the organisation, better positioning charitable and social sector organisations to win more contracts.

Worked Example of RPN

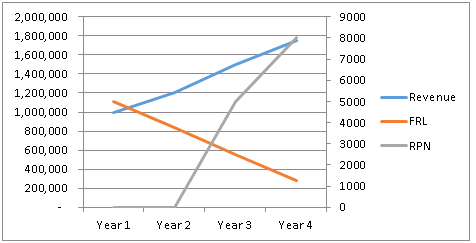

Below we set out 2 scenarios, setting the interest costs of a RPN against those of a more typical fixed rate loan – one where revenues grow as expected , and one where they do not. Both are based on the interest costs of an organisation with a £1m turnover taking a £100,000 loan at 6% over 4 years, and compared it to a RPN where the organisation pays 2% on any revenues above £1.25m.

Scenario 1

In the case where revenues perform in line with expectation, the RPN is slightly more expensive overall than the fixed rate loan, but does not require cash repayments in the earlier years of the loan.

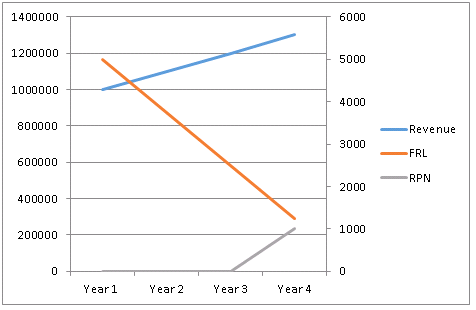

Scenario 2

In the below chart we consider the impact of revenues not growing in line with the forecast.

In this scenario, the RPN is significantly cheaper than the fixed rate loan, despite revenue growth in each period, generating savings for the investee due to the risk sharing element of the RPN.

Is it relevant to your organisation?

An RPN could be a relevant funding option for you if you are:

- A registered social enterprise or charity

- Looking to finance growth or innovation

- Would like to have an element of down side protection in the even that growth does not happen as planned, in return for sharing the success if it does

It would not be appropriate however if the funding will not lead to a growth in revenues e.g. purchasing existing office building.